So a lack of budgeting and not tracking our spending had a huge impact on our financial situation. We assumed we were spending about $100 a month on eating out. In reality, we were spending about $900 a month. We assumed we were spending $600 a month or so on groceries. When we decided to go back and add up our previous annual spending, we were floored at what we found. Instead, I made an estimated budget each month and assumed we followed the numbers. The problem was that I wasn’t tracking our spending. We couldn’t figure out why we were in the hole each month.Īfter all, we weren’t making large purchases. In our particular case, it was a simple lack of budgeting and not tracking spending that got us into that debt. My family and I used to be saddled with over $60,000 in consumer debt. Remember that it’s important to tailor your budget to fit you/your family’s personal needs and lifestyle. The area you live in (cost of living varies from city to city) and what your financial goals are will have an impact too. Your budgeting percentages may vary from these suggestions due to the size of your family. Here are some guidelines that will help you to make your budget.

If you’re not too keen on jotting down all your dollars and cents on paper, then try using an effective online tool instead.

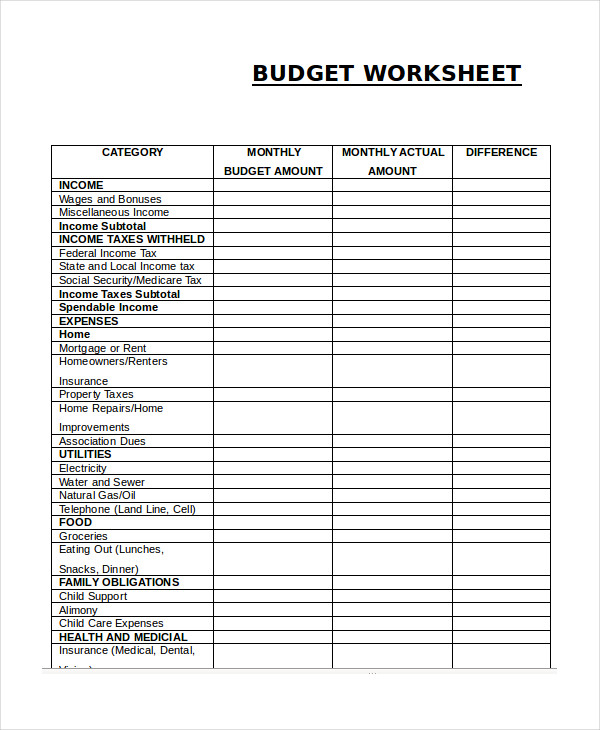

#Basic household budget download#

You’ll be able to set more money aside for things such as investments, an emergency savings account, and so forth.Ĭlick here to download the XLS file home budget template.xls. As you get a better grasp of your finances each month, things should change for the better. The whole idea behind budgeting is that it helps you manage your money better on your own terms that you’re most comfortable with. Revise certain percentages in your budget, and identify what areas you’re still overspending in. If you’re not, it’s time to revise your budgeting strategies. This will help you determine whether or not you’re still on track. Look over your budget at the end of each month, and identify whether or not any of your habits have changed. Use a simple-to-use home budget template to better understand your financesģ. Redirect your leisurely funds towards paying off debt, and getting your final number back into the positives. In particular, you need to sacrifice expenses from your “leisure” category, such as dining out, entertainment, non-essential shopping sprees, and so forth.Īs tough as this may sound, it’s only a temporary situation that will help lead you to long-term financial stability. The simple solution here is much easier said than done – you’ve got to slash your spending. If you end up with a negative number, you know that you’ve got to make some adjustments.Īfter completing step 1, if you find that a negative number is calculated, you are most likely overspending. After adding up these numbers, you’ll have an accurate idea of how much you spend.Īfter subtracting all these expenses from your monthly take-home pay, you’ll see right away if what you earn is adequate enough to cover these costs or not. The best way to identify this number is to keep each and every receipt from all your expenses, and tally up a total. Many people underestimate how much they spend, which can be a dangerous thing when it comes to keeping household finances in order. You might have an idea of how much you spend each month, but without cold-hard math, you really don’t have a clear indication of how much money is going out. Follow these tips to creating an effective budget for your home and family:ġ. It’s important to confront your finances and create an effective household budget to help you get a grasp on your finances and limits. Managing household expenses can seem like a scary thing, regardless of whether you’re living on your own with your partner for the first time, or are an experienced homeowner with kids.

#Basic household budget free#

Click below for the free budget template that matches your lifestyle

0 kommentar(er)

0 kommentar(er)